Opening Doors to Employment: Imani Global Logistics Serves the Community with Flexible Funding provided by TEDC

With years of experience in healthcare, Nancy Grayson, Ph.D., didn’t start out with a desire to own a business. But her drive to help people find jobs led her to launch her own delivery company. Her current venture, Imani Global Logistics, delivers vital medicine to hospitals, utilizing vehicles purchased through funding from TEDC Creative Capital.

Sharing a Love of Food: TEDC Client Curds and Whey Thrives at Mother Road Market

Curds and Whey is in its fourth year at Mother Road Market in Tulsa, and chef/owner Faith Walker is excited for what the future holds for her small business.

Flying into the Future: Drone Testing Facility Skyway Range Grows with Flexible Funding from TEDC Creative Capital

This innovative drone testing center is powering new technology and fueling economic opportunity across the state, thanks partly to flexible funding from TEDC Creative Capital.

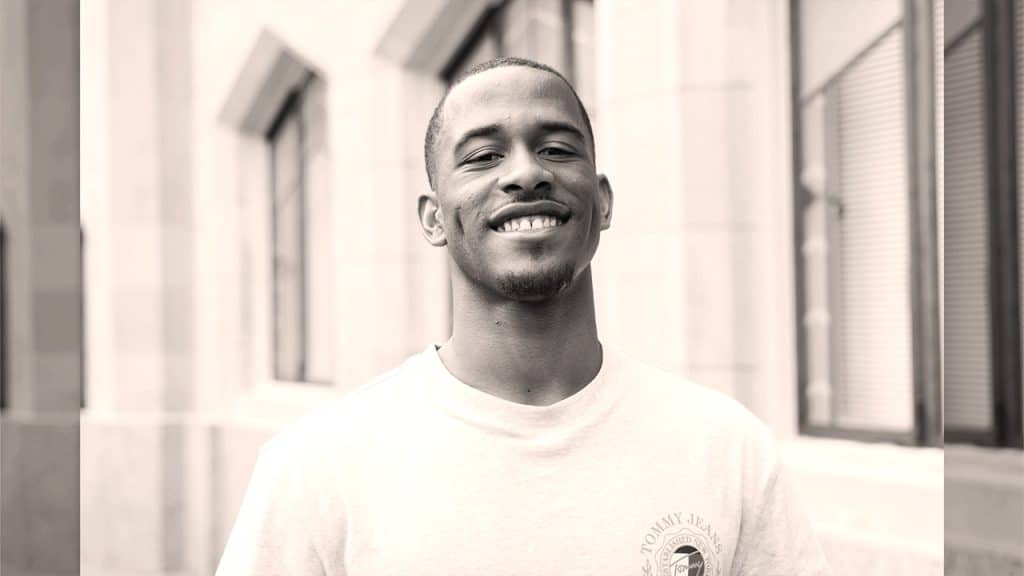

Making the Right Moves: Stellar Focus Media Scales Up with a Microloan from TEDC

As a young entrepreneur, Tulsa native Joel DeArchae Mackey has been fortunate to find his passion in something that could become a full-time way to earn money. As owner and head Creative Director at Stellar Focus Media LLC, he helps fellow business owners build their social following and promote their companies through video, ads, and more—with equipment funded by a microloan through TEDC Creative Capital.

From Fantasy to Fruition: Silk Salon Launches with Help from TEDC

TJ Woodberry, whose serial entrepreneurial ventures include Poppi’s Spa and Lounge, opened Silk Salon in January 2025. With its elegant, indulgent vibes, Silk Salon is dedicated to prioritizing the client experience. When she was ready to launch, she turned to her trusted financing team at TEDC Creative Capital to help bring her vision for Silk to life.

TEDC Partners with JPMorganChase in Helping Entrepreneurs Improve Credit Scores and Obtain Financial Health

Table of Contents: A Single Number with Powerful InfluenceA Firm Foundation in Financial WellnessBuilding Generational Wealth Through Thriving Small BusinessesLearn More to Apply or Serve as a Mentor Personal financial health can make or break an entrepreneur’s business success—especially if you have a low credit score. Through TEDC’s Personal Money Management for Entrepreneurs program, funded…

Empanadas and More: Delicious Ecuadorian Meals Served Up at Tulsa’s Que Gusto

As owner and chef at Que Gusto, Carla Meneses is bringing the delicious taste of Ecuadorian food to Tulsa. With help from TEDC Creative Capital, she is expanding her kitchen and setting up her business for future growth.

Building for Growth: Funding from TEDC Is Helping Byweld 2nd Generation Reinvent Its Fab Facilities

Welding metal fabrication company Byweld 2nd Generation fills an important niche serving engineering firms and shipping their fabrications to oil and gas refineries in Tulsa, the U.S., Canada, Spain, and elsewhere.

For Love of Fashion: BY.Everyone Launches in Tulsa with Help from TEDC

As owner and creative director for BY.Everyone, Elyjah Monks develops clothing under his own label and collaborates with local designers. He’s weathered the ups and downs of the fashion industry, Covid’s effect on retail, and a move to a different market—and is now growing his own fashion label with help from TEDC Creative Capital.

Serving Up Sweet Treats with Asian Flair: Kremee Delights Tulsans with the Help of TEDC Creative Capital

Table of Contents: An Unexpected Swerve into Soft ServePursuit of a Sweet PassionOpening a New Kind of Ice Cream ShopBringing the Details Together for Their BusinessLaunching Kremee Breeds New ChallengesFinding Local Business Education ResourcesFuture Dreams to Dish Up Happiness Tasty soft-serve ice cream with a twist? Yes, please! Delightful creations mixing traditional American and Asian…